Give your employees a financial sidekick

Wave goodbye to employees losing sleep over money. We bring together AI-driven financial guidance, top-notch education, and a helpful human just a text away.

Watch a demo

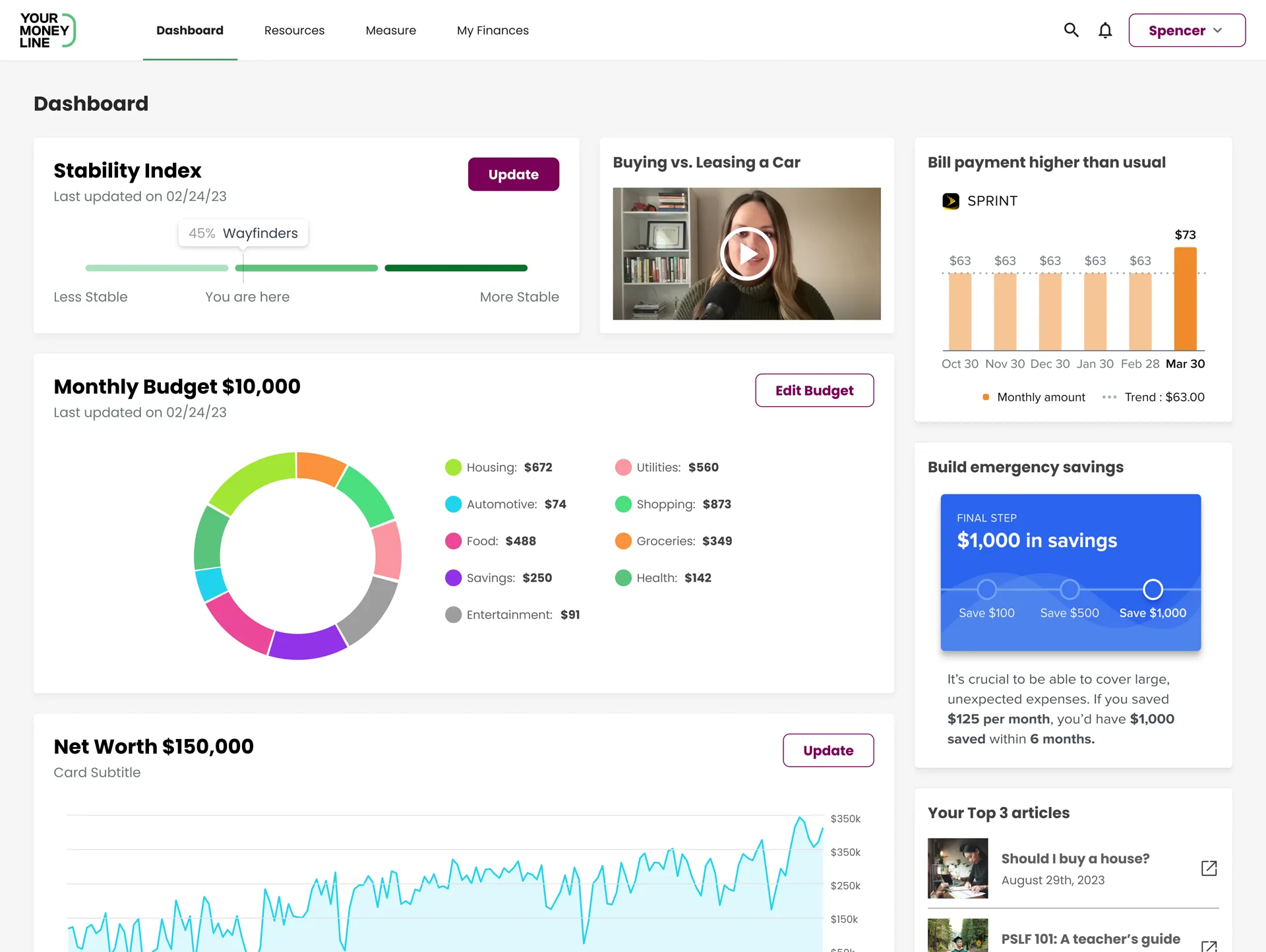

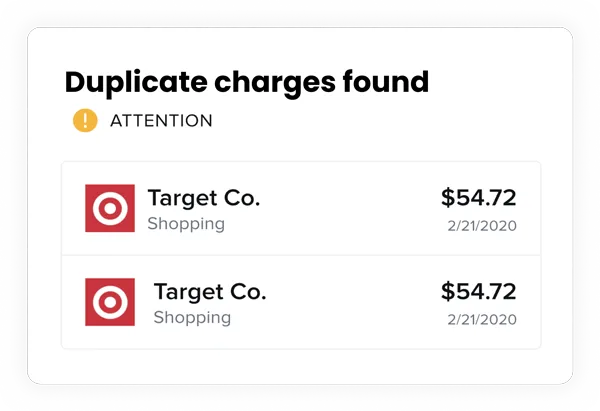

Our software is the 24/7, intelligent money coach for employees

Benefits leaders are our heroes.

We're here to make your job easier.

Keep a pulse on employee financial health with an aggregate view of company data in our admin dashboard

.svg)

Increase benefits utilization as we answer questions about and refer employees to the other benefits you already offer.

Trust bank-level security to keep your employee's finances secure and stay up to date with the latest standards in privacy.

Every employee deserves someone they can talk to about money

Give every employee access to personalized advice from real people. Our team of financial guides exists solely to coach your employees toward healthier financial lives.

We've done this before. All of our Guides are Accredited Financial Counselors® and/or Certified Financial Planner™ practitioners, so your employees are in experienced, knowledgeable hands.

Financial Guides meet employees where they’re at, shame-free, with an individualized approach to financial stability. Employees can also schedule repeatedly with the same guide to build trust.

Unlike an EAP or 401k plan, there's no limit to the number of times an employee can contact a guide. We hope they do it a ton! Guides are available by chat, email, text, or phone.

Every interaction between the guide and the participant is 100% confidential—we only report aggregate data to the employer. And unlike other financial offerings, we don't try to sell employees anything. Our only job is their financial wellness.

A world-class financial education for every employee is just a click away.

We've coached people through financial challenges for two decades, and along the way, we've created hundreds of hours of helpful content to help employees learn essential money skills.

Courses

Stability Academy

Expert Analysis

Podcast

We’re not just a service, we’re a partner.