Meet the employee benefit that changes financial lives

Make a difference for every employee

Keep your best people

Employees have high expectations and retaining them has never been harder. Showing your employees you care about their future, improves employee satisfaction.

Reduce employee stress

Our financial experts reduce stress by listening with empathy and creating an action plan to provide stability. If employees are worried less about money, you should see increased engagement at work.

More savings & benefit usage

When employees struggle to make ends meet, they can’t save for the future. We help your employees’ money go further and break the paycheck to paycheck cycle.

Scale your HR team

HR leaders wear many hats. We take financial wellness off your plate. YML is speedy to launch, easy to operate, and offers confidential, 1:1 support to every employee.

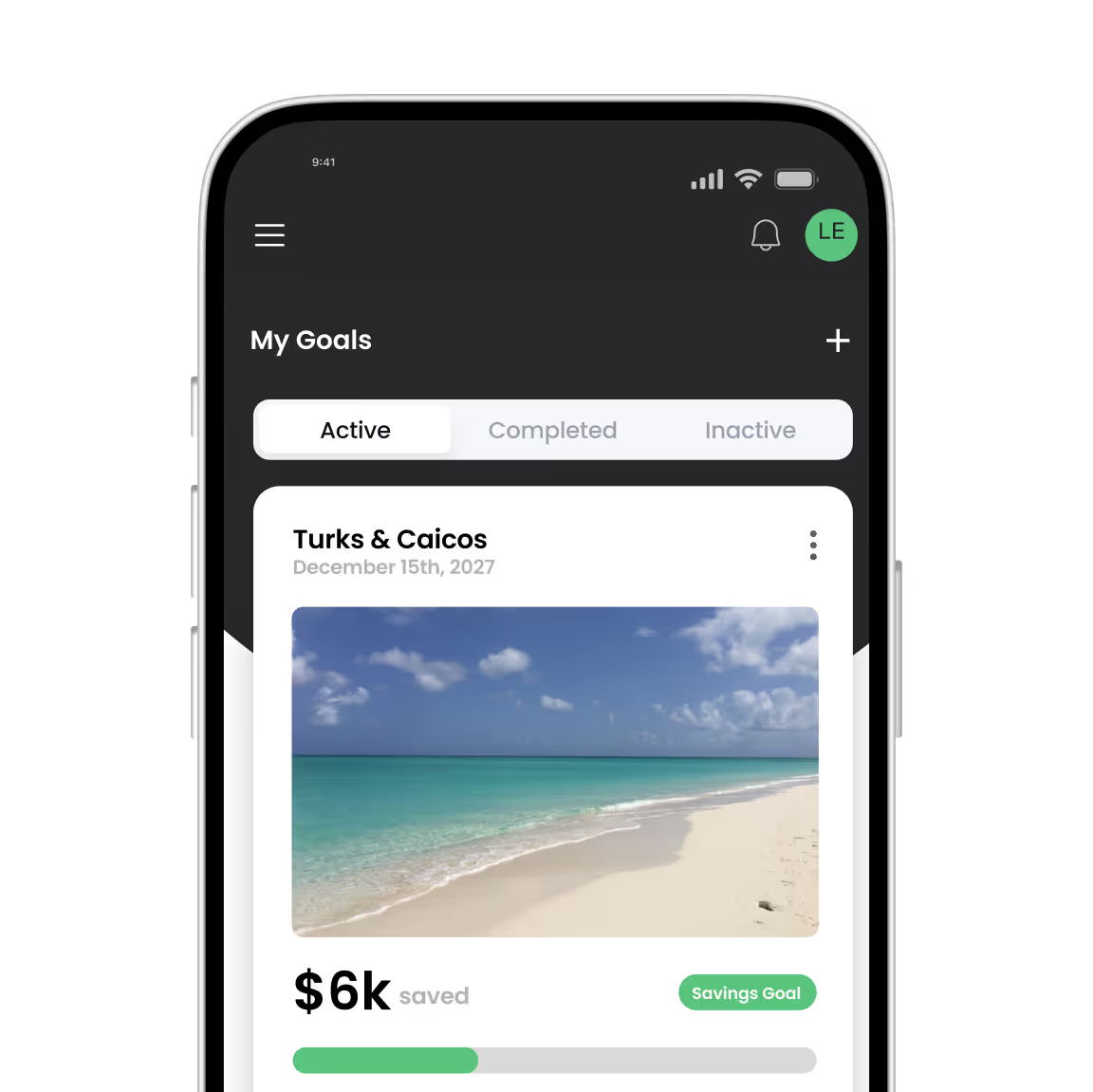

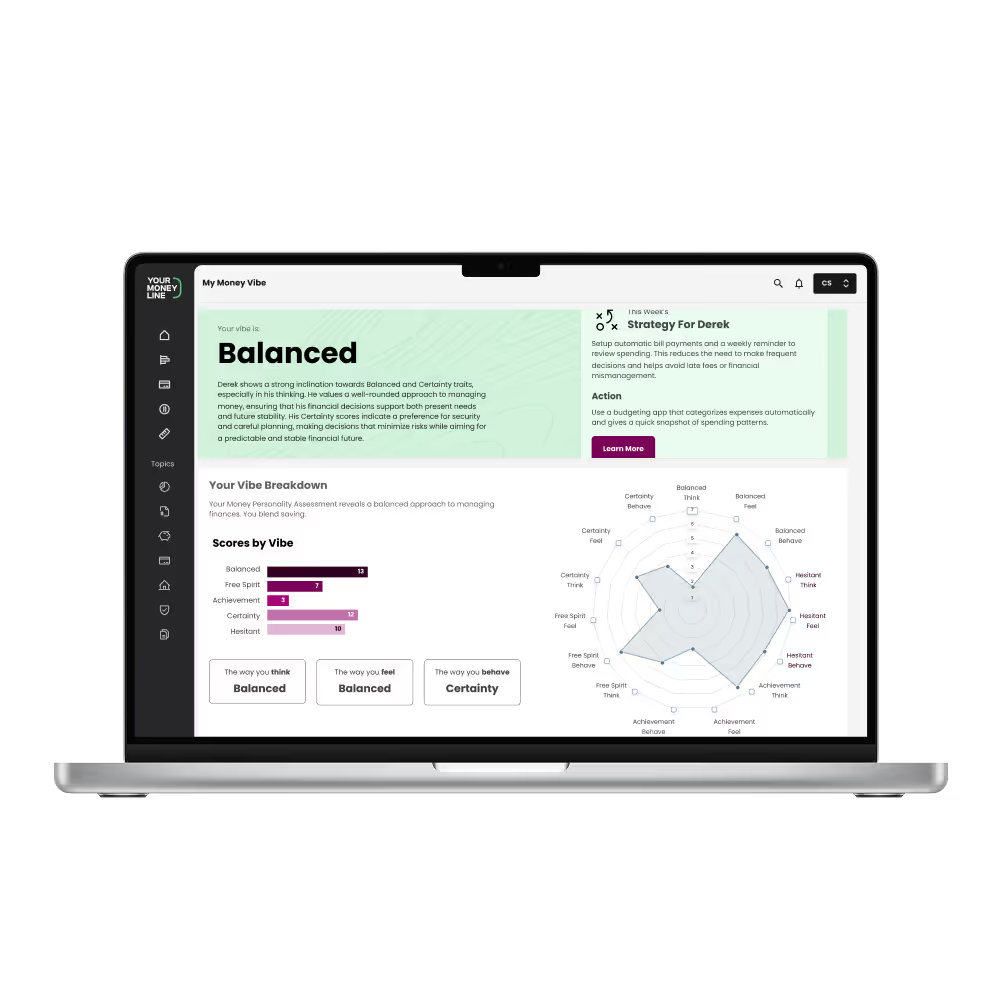

All-in-one-money app

Give your employees one place to see and stay on top of their money. With the YML mobile app, employees get AI budgeting, spending insights, credit monitoring, resources and more.

Unlimited 1:1 financial coaching

Offer unlimited access to our team of certified financial coaches to help your employees navigate financial challenges, overcome stress, and plan for the future—zero shame, zero sales pressure.

On-demand money education

Help employees learn essential money skills—on their schedule, at their own pace—with easy-to-follow courses, videos, worksheets, articles, and more on dozens of financial topics.

.avif)